Alternative Insight

The Battle for Income Equality

Questioning the statistics in Thomas Piketty's best selling book, Capital in the Twenty First Century, with intent to undermine his thesis, is futile. Even if Piketty's alert to the economics community that returns on investment have exceeded the real growth of wages and output, which means that the stock of capital is rising faster than overall output, may not be exact, the criticism has neglected to upset the conclusion - severe income inequality and inequitable wealth distribution doom the capitalist system to an eventual collapse, and a more narrow distribution keeps it going.

Progressive economists connect meager wage growth to limited purchasing power -- one cause of the 2008 crash - and increased concentration of wealth to cautious job growth in the post crash years. Their conclusions have engineered a debate on how to achieve more equitable distributions in wages and wealth and raise middle class wages, deciding what roles private industry, government and labor unions have in achieving a more equitable society.

If private industry refuses to meet its obligations to readjust the divide, then Thomas Piketty recommends increasing taxes on high earners and large estates, coupling them with a wealth tax as a method for resolving income inequality, giving government taxing power a major role in correcting the unequal distributions of income and wealth.

Unlike previous decades, when unions had a larger membership and more clout, labor lacks strength to move management to meet its wage demands. Nor does government have a mechanism to force corporations to transfer productivity gains into wage gains. Is it a matter of education? Must corporations be made to realize the social and economic benefits of decreasing income inequality and increasing middle class purchasing power, if not on an individual basis then for the total national economy? Lowering remunerations to those in top pay brackets and increasing them for lower income workers is more than a moral obligation; it has direct benefits to the economy for everyone. It is a must for achieving a stable economy.Social costs due to less equitable income and wealth distributions.

Rationalizing ill distributions by describing the American poor as wealthier than the lower middle class in many developed nations is deceiving. Poverty is defined as an absolute number but its effects are relative. The lower wage earners in the United States are unaware of what they have in relation to foreigners; they are aware of what they do not have in relation to others living close to them. The wide disparity in wealth creates resentment and tension leading to psychological and emotional difficulties. Minimizing social problems means combining the giving of more to the lower classes with the taking of less by the upper classes.

The social problems and associated costs in developed nations that have wide distributions of income and wealth are well documented - elevated mental illness, crime, infant mortality, and health problems. One statistical proof -- the United States, classified as the most unequal of the developed nations, excepting Singapore, has the highest index of social problems. The graph below from 2010-2011 and a previous article, Health is a Socio-Economic Problem, describe the relationship.

Every citizen suffers from and pays for the social problems derived from income inequality, an unfair condition in a democratic society. Private industry has an obligation and an opportunity to fix the problem it has caused. If not then, Uncle Sam, whom they don't want on their backs, will reach into their pockets, redistribute the wealth and resolve the situation.

Income inequality produces wealth concentration and this has political consequences. Wealthy individuals are more and more controlling the political debate, influencing selection of candidates, having their interests placed before national interests, and determining the directions of political campaigns. Skewing the electoral process distorts government and the decisions that guide social and economic legislation. Democratic prerogatives, fair elections and equality before law are all reduced by wealth concentration.

The Sunlight Foundation, in an article, The Political 1% of the 1% in 2012 by Lee Drutman, June, 2013, presents a fact filled discussion of this topic.

More than a quarter of the nearly $6 billion in contributions from identifiable sources in the last campaign cycle came from just 31,385 individuals, a number equal to one ten-thousandth of the U.S. population.

Of the 1% of the 1%'s $1.68 billion in the 2012 cycle, $500.4 million entered the campaign through a super PAC (including almost $100 million from just one couple, Sheldon and Miriam Adelson). Four out of five 1% of the 1% donors were pure partisans, giving all of their money to one party or the other.

These concerns are likely even more acute for the two parties. In 2012, the National Republican Senatorial Committee raised more than half (54.2 percent) of its $105.8 million from the 1% of the 1%, and the National Republican Congressional Committee raised one third (33.0 percent) of its $140.6 million from the 1% of the 1%. Democratic party committees depend less on the 1% of the 1%. The Democratic Senatorial Campaign Committee raised 12.9 percent of its $128.9 million from these top donors, and the Democratic Congressional Committee raised 20.1 percent of its $143.9 million from 1% of the 1% donors.

To the many billionaires who are tilting election campaigns, add the political contributions by super sized corporations and industries, and electoral control by the wealthy becomes complete. Campaign contributions from the financial sector, the same financial sector that increased its own liabilities from 10 percent of GDP in 1970 to 120 percent of GDP in 2009, and shifted investment from manufacturing to rent seeking, making money the new fashioned way, leads the way.

The Sunlight Foundation article The Political 1% of the 1% in 2012 states:

In 1990, 1,091 elite donors in the FIRE sector (finance, insurance, and real estate).contributed $15.4 million to campaigns - a substantial sum at the time. But that's nothing compared to what they contribute today. In 2010, 5,510 elite donors from the sector contributed $178.2 million, more than 10 times the amount they contributed in 1990.

As the graph shows, the FIRE sector increased its wealth by borrowed money, making the economy work for it rather than working for the economy, growing itself until leading the nation into the 2008 economic disaster.

The Economic Consequences of Wealth Concentration

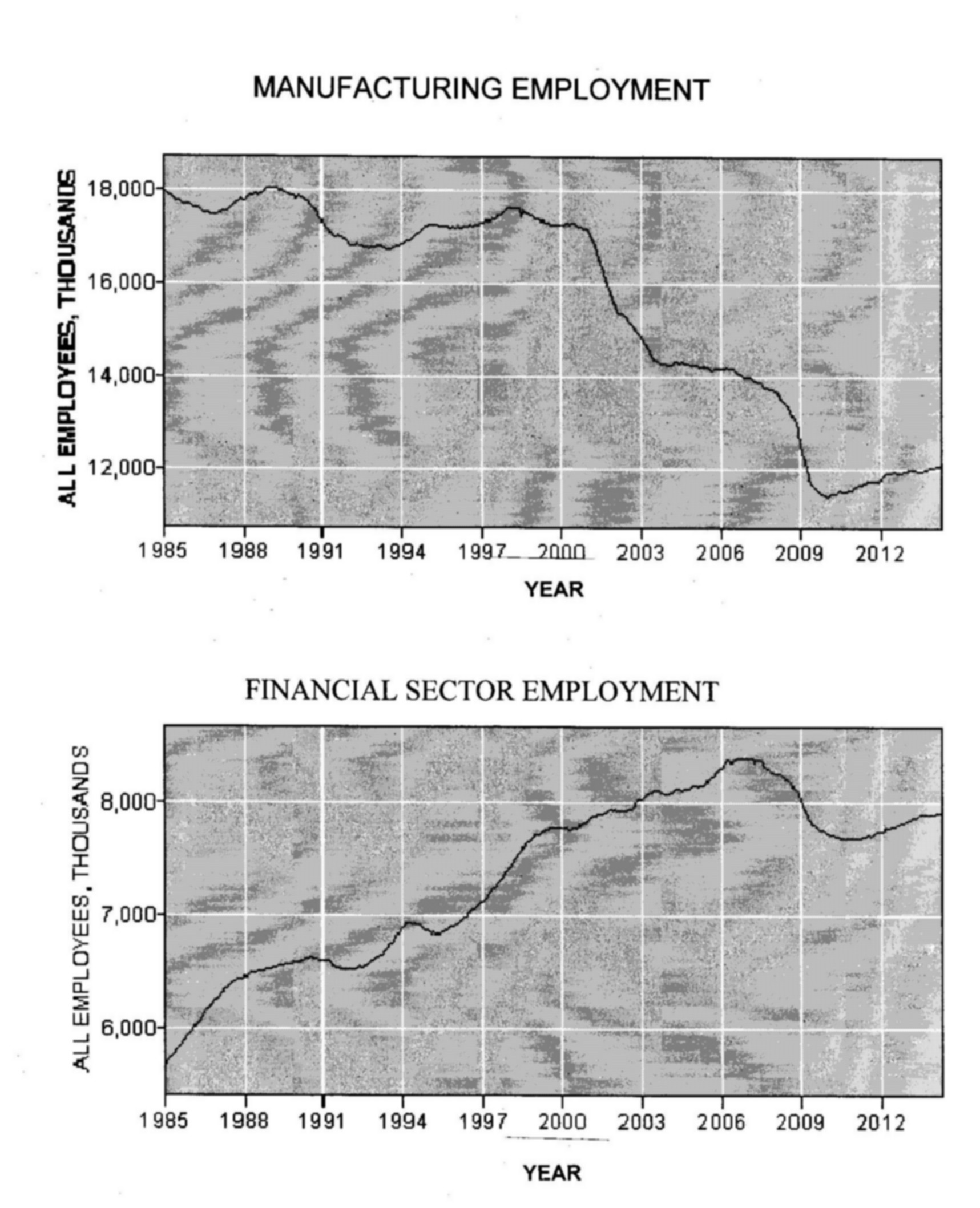

What has occurred with wealth concentration? The last decade indicates a deflection of investment from dynamic industrial processes to static rent situations, from industries that employ workers to make goods to industries that employ money to make money. A few graphs from the Bureau of Labor Statistics (BLS) record the trend.

The graphs plot employment in the manufacturing and financial sectors, Manufacturing had a slow deterioration during the Reagan presidency, followed by stability during the Clinton administration and then a sharp decline during the George Bush era. Some deterioration in manufacturing employment is understandable -- administrative jobs (clerical, administration) has been displaced to information technologies and these fields have added jobs, factory floor work of consumer goods has been displaced by machines (robot, numerical control) that have their own factory floors and labor has been transferred from highly labor intensive manufacturing to less labor intensive industries. However, the employment loss is excessive and bewildering when compared to the increases in financial employment. Does a healthy economy result from a steady growth in financial workers and a consistent decrease in industrial workers?

Beginning in the Reagan era until economic collapse in 2008, employment in the financial sector monotonically increased, except for slight blips during the 1991 recession and a few years of the Clinton administration. From of a ratio of 1/3 in 1986, financial sector employment rose to 2/3 that of manufacturing employment by 2014, and increased by more than the changes in their respective additions to the Gross Domestic Product. The Bureau of Labor Statistics (BLS) shows the value added by each industry.

Manufacturing rose from $1390.1 billion in 1997 to $2079.5 billion in 2013, an increase of 50 percent.

Finance, insurance, real estate, rental, and leasing rose from $1623.1 billion in 1997 to $3293.2 billion in 2013, an increase of 100 percent.

A comparison between salaries of engineers, those who contribute directly to industrial growth, and financiers, those who drive active and passive investments, also reveals the importance given to those who make money from money.

One of the contributors to Capital, Thomas Philippon, in an article Wages and Human Capital in the U.S. Financial Industry: 1909-2006, NBER Working Paper No. 14644, January 2009, shows that wages for the financial sector started a steady growth during the Reagan administration, and eventually exceeded engineering wages, especially for those who had advanced degrees from the elite universities.

As the FIRE industry expands, purchasing power contracts, one reason being that part of the rent seeking covets higher returns and gets sidetracked into endless speculation; money rolling over and over and never available to purchase anything but pieces of paper. Millions of arbitrage transactions per second can earn thousands of dollars per second, which adds up to 3.6 million dollars per hour. No positive affect to the economy; only paper dollars continually created.

Stagnant labor wages and weak purchasing power force expansion of credit to increase demand, and when that stalls, government deficits are used to turn around a falling economy. The wealthy respond with accelerated demand for larger houses, larger cars, and more luxury goods, spending that raises asset values and places middle class earners at a disadvantage. The bottom ninety percent on the income scale desperately pursue debt to give themselves a temporary share of prosperity. Debt must eventually be repaid. Real wealth remains with a privileged few and others go bust.

What is the Result?

Thomas Piketty has reshaped thinking of the Capitalist system. Understanding how and when to increase demand, enable sufficient purchasing power, and what are profits demand an understanding of economics, possibly less the conventional economics of modern theorists and more the classical economics of the fathers of political economy - Adam Smith, David Ricardo and Karl Marx. Wages provide purchasing power, and beyond what is bought by that purchasing power is surplus, whose value allows profit.Who can buy the surplus? Where is the purchasing power for accomplishing the task? A positive balance of payments and credit are the principal mechanisms, and the money supplied by government deficits emerge as a last opportunity. However, no concerted effort is being made to correct the decades of financing the current account deficit with government deficits and reducing the dependence of the system on credit. And what happens with the profit? If not given as dividends or reinvested, the production system slows until it stumbles.

Piketty has shown that the latter is occurring - profits are being sidetracked into passive investments that produce only more capital and not useful goods, into accumulation of excessive personal wealth, and into financial speculation that features the constant churning of paper money, which removes dollars from the market and creates difficulties for manufacturing to grow. Accumulation of excessive wealth generates social problems, which diminish the quality of life and burden the middle class as taxes are used to seek relief.

Routes to ameliorating these deterrents to a fair and successful economy are hindered by capture of the political system by those most responsible for the problems - the privileged wealthy who manipulate a portion of the electoral process for their advantage. Due to their financial clout they are able to have their voices more easily heard in the Congress and before federal agencies.

Karl Marx claimed that Capitalism contains the seeds of its own destruction. Those who foster severe income inequality and inequitable wealth distribution apparently want to prove the statement is correct.

alternativeinsight

june 2014HOME PAGE MAIN PAGE

alternativeinsight@earthlink.net comments powered by Disqus