Alternative Insight

How Ronald Reagan Sank America

As the memory of Ronald Reagan's administration recedes, estimation of his deeds grow.; and for good reason. A cursory look at his end-of-office stats impress the casual observer - GDP increase of 67% from $3 trillion in 1981 to $5 trillion in 1988, net job addition of about 18 million, reduction in the unemployment rate from 7.5% to 5.5%, one of the longest peacetime expansions in U.S. history, and inflation rate falling from13.5% to 4.1%. More detailed analysis reveals a contradiction: Reagan's policies had little to do with the economic progress, and his policies started the United States on its road to eventual economic stress.The essentials of Reagan's economic policy.

Reduce government spending,

Reduce income and capital gains marginal tax rates,

Reduce government regulation,

Control the money supply to reduce inflationThe graph on the right shows federal debt increasing from $998 billion to$ 2.6 trillion during Reagan's reign. The graph on the left has credit outstanding doubling from $5 trillion to $10 trillion during the same period. Reagan's fiscal policy directly opposed his stated objectives and those of the GOP. The 40th president of the United States did reduce

income and capital gain taxes, but there is no proof that these determined the prosperity.

Actually, Reagan signed into law tax increases of some nature in every year in order to fund government programs. Huge increases in FICA and signing of the Tax Equity and Fiscal Responsibility Act, described as the "largest peacetime tax increase in American history," describe Reagan's ambivalence to tax reductions. If the budget was balanced then a reasonable conclusion could relate the growth of GDP to a cut in taxes. However, the economic stimulus due to deficit spending and credit expansion (why necessary, if taxes were cut), coupled with the reduction of oil prices and interest rates, probably played the more significant role in the GDP rise. Note that the graph of GDP coincides with the curve of credit outstanding. Also note that all these curves started towards an exponential increase during the Reagan administration. Only Bill Clinton's balanced budgets interrupted the monotonic excursion of the federal debt, launched during Reagan's tutelage.

True to his word, Reagan offered some deregulation. Was it beneficial? Deregulation has been accused of being one cause of the 2008 economic downturn. The Garn–St. Germain Depository Institutions Act of 1982, which deregulated savings and loan associations and allowed banks to provide adjustable-rate mortgage, contributed to the savings and loan crisis of the late 1980s. However, William A. Niskanen, a member of Reagan's Council of Economic Advisers has written that deregulation had the "lowest priority" of the items on the Reagan agenda." Reagan "failed to sustain the momentum for deregulation initiated in the 1970s" and he "added more trade barriers than any administration since Hoover."

As for, controlling the money supply to reduce inflation, the policies should have done the opposite. Paul Volcker. who chaired the Federal Reserve from August 1979 through August 1987, resolved the anomaly:

"It always seemed to me that there is a kind of common sense view that inflation is too much money chasing too few goods. You could oversimplify it and say that inflation is just a monetary phenomenon. There are decades, hundreds of years, of economic thinking relating the money supply to inflation, and people to some extent have that in their bones. So I think we could explain what we had to do to stop inflation better that way than simply by saying that we've got to raise interest rates. It was also true that we had no other good benchmark for how much to raise interest rates in the midst of a volatile inflationary situation.

Then in October [1982], or whenever it was, the money supply (by some measures) was increasing again rather rapidly. We had a tough explanation to make, but I thought we had come to the point that we were getting boxed in by money supply data that was, in any event, strongly distorted by regulatory changes and bank behavior. We came to the conclusion that it was not very reliable to put so much weight on the money supply any more, so we backed off that approach."

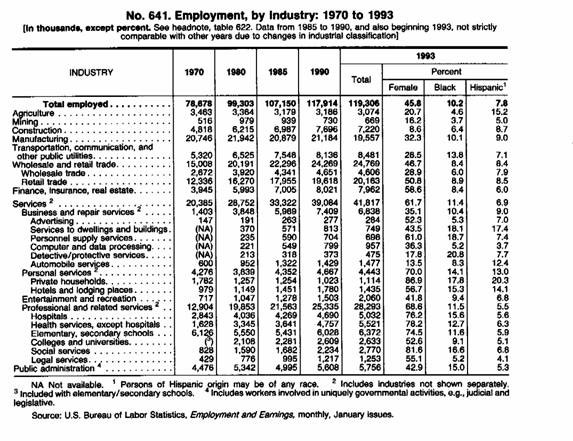

And now we come to the most often cited success of Reagan's policies; an increase of 18 million jobs, all of which arrived at the non-manufacturing sectors. The Bureau of Labor statistics, shown below, report 11 million growth in the service industries, 4.5 million in wholesale and retail trade and 2 million in the financial industry.

All of this is welcoming and significant. However, these industries are not export industries and are, in effect supported by the surplus income of manufacturing workers. Banks don't lend to consumers to buy hamburgers, and going to a doctor doesn't increase assets. Services, trade and finance create intangible assets and not the tangibles that have a defined price.

This leads to Reagan's greatest failure; during an era of global prosperity, and while Japan and Germany enhanced their export industries, America started its monotonically increasing deficit in its surplus account. As the graph above shows, 1983 was a fatal year for the United States; the year it became a global debtor nation and depended upon outside investment in order to survive. During the Reagan decade, Japan's current account balance went from a record deficit of US$10.7 billion in 1980 to a record surplus of US$87 billion in 1987 before declining to US$57.1 billion in 1989. Similarly, the Federal Republic of Germany, after experiencing deficits during 1979–81, had its current accounts balance rebound to about a DM 9.9 billion surplus in 1982 and increase to DM 76.5 billion in 1986. While Reagan talked mellifluously, the world's principal nations trade (including an emerging China) flowed with honey. Examine all the graphs and tables and he conclusion becomes obvious: Reagan's policies, which increased federal and private debt at exponential rates, decreased manufacturing employment, and turned a positive current account into an ever mounting negative, established the trends towards America's eventual economic problems. Reagan sunk America.

alternativeinsight

february, 2011

HOME PAGE MAIN PAGE

alternativeinsight@earthlink.net