Alternative Insight

Re-examination of Productivity and Wages

A New Look at an Old issue

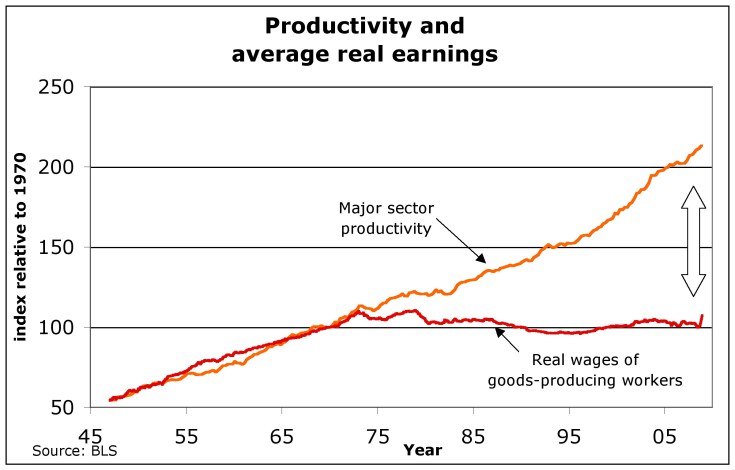

Allied to the thrust for diminishing income inequality is a push to return to a previous relationship between productivity and wages. From 1950 to 1975, real wages closely followed increases in productivity. In succeeding years, real wages grew much slower than productivity; wages of goods-producing workers (not all workers), as shown in the graph, remained relatively stagnant.

One proposed solution to overcoming market stagnation and reduced demand is to amplify purchasing power by again increasing wages proportionately to productivity increases. Corporations accepted this fair and sensible concept during the economy's growth from the ruins of World War II until an overwhelming international reach and intense global competition modified perspectives. Trade agreements and the expansion of global markets changed the executive mindset, and business preferred to use increased productivity to increase profit margins.

The chart below describes the increase in profit margins -- a slow increase during the Reagan presidency and first Clinton administration, an entrenchment during the second Clinton era and then a sharp rise during Bush's stay in the White House, followed by the inevitable - a severe recession whose losses wiped out some of the previous profits. After the Great Recession, and during the 'friendly to labor' Obama administration, profit margins exceeded all previous records.

One impression from the graph is that profit margins seek a natural level of about five percent. No scientific or analytical proof for this observation, but something to think about. It could be related to the amount of consumer credit the system will sustain. If so, the abrupt rise in the short years since the 2008 downturn portends an even greater fall.

In simple terms, raising wages with increased productivity allows workers to purchase more of their production, which reduces some of the added surplus and permits a slight rise in profit from selling the renaining surplus -- an acceptable provision to the owners of industry when markets were predominantly domestic and workers introduced their own efficiencies, and before information technology and robotics played a significant role in productivity increases, partly by worker replacement, especially in administrative and office work.

Information technology has provided a variety of savings for industry - on time inventory, advanced modes of communication, distribution, training, advertising and sales. Explosive growth in international markets expands the opportunity to sell the added surplus by exports and increase profit margins. If exports are insufficient to sell the last of the surplus product, then government deficits will supply the additional purchasing power to the economy. This has happened during the Obama administration, where government debt partially subsidized corporate profits and the current account deficit, the latter resulting from multinationals producing basic goods in faraway places, causing U.S. imports to rise and the trade balance to go severely negative.

Increasing worker compensation as a direct function of productivity has, in the past, increased domestic consumption and elevated living standards. However, in America, although the standard of living of the working class and access to material goods are major issues, a more major issue is secure and well paying jobs for all, and that issue is complicated by restraints from the last decades - continuous outsourcing and excessive current account deficits. Expanding the job market implies reductions in outsourcing and the current account deficit and is not directly related to increasing wages of those already working. Because lower prices stimulate exports and static labor rates dissuade outsourcing, lowering prices as a function of productivity and maintaining wages provide incentives for increasing domestic production and expanding the labor market.

This audacious suggestion, which at first glance seems to contradict the shibboleths of modern business life - maximize profits, minimize costs and do not retreat on prices - is one step in the new look at managing a capitalist economy -- preventing extremes in economic cycles, reducing the current account deficit, reducing government debt, minimizing credit expansion and proceeding to full employment. Seemingly politically and economically incorrect, the suggestion recognizes that the economic environment has changed in the global era and past approaches to some problems have become obsolete.

If production per man hour increases, and prices are held constant, it has been assumed that wages must be raised to assure there is sufficient purchasing power to absorb the added production. However, if prices are reduced proportional to productivity, static income will be able to purchase the same amount of added production. Irrespective of which direction is taken, labor can receive a similar benefit. The return on capital increases at a slower pace than when prices are not lowered, but the advantages to industry and to the nation are extraordinary.

Imagine, if since 1980 U.S. industry lowered prices with gains in productivity and held wages relatively constant. The prices of U.S. goods would be much less than they are today, which means that worker purchasing power, which has been stagnant, would have increased substantially, U.S. goods would be more competitive on the world market and consumer debt would be lowered. Exports would greatly expand, outsourcing would be reduced, jobs would be plentiful, the current account might be positive, and the government would probably run a much smaller deficit or even a surplus. The ultimate prosperity has arrived in the fifty states.

Companies can handle productivity gains with different approaches.

(1) Permit wages to slowly grow, lower prices, and attempt to sell the added production as profit.

The post Civil War years of rapid advances and high productivity, with some years of economic instability, characterize this approach. Portrayed as The Gilded Age, and named the Second Industrial Revolution, a great deflation occurred -- prices of most basic commodities fell almost continuously, and wages remained steady.

Although statistics from the era are controversial, conclusions in D. Beckworth's article The Postbellum Deflation and its Lessons for Today, North American Journal of Economics and Finance. P. 198 (2007), show that from 1870 to 1900, real GNP tripled, prices fell 40 percent, mostly from an initial reaction to the Civil War inflation, and real GDP/capita increased by 60 percent. The government Census Bureau has the workforce increasing from 12 to 27 million people during the same period.(2) Have the work force slowly grow and increase their wages in a proportion to productivity gains. Despite the added costs, selling the added production enables increased profits.

Industry proceeded with this approach from post World War II until a rapidly expanding global economy turned the trade balance negative and forced multinational corporations into exaggerated outsourcing. From Trading Economics, we learn that Real GDP increased from $2 trillion to $6.5 trillion during the period from 1950-1980. The Bureau of Labor Statistics has civilian labor force increasing from 58 million to 99 million and the Consumer price Index (CPI) remaining relatively constant at 25 until the year 1968 when it started to abruptly rise, reaching 75 in the year 1980.Note that economic growth during this era compared well to that of The Gilded Age. Both prosperities (a financial panic occurred in 1893 and no equivalent occurred in the post World War II prosperity) followed wartime hardships but differed in the directions of their Consumer Price Indexes.

(3) Maintain real factory wages constant (see figure above) and increase them in finances and services. Expand GDP and profits rapidly. Here we start with the Ronald Reagan era and end with the 2008 bust during the George Bush administration. The relative rise of the CPI from about 80 to 215 wiped out most wage increases.

(4) Decrease the work force, maintain the wages and keep production at a slow growth.

The reduced costs translate into increased profits. This has been the approach after the 2008 economic decline, featuring a gradual rise in GDP and profits and a slow decrease in unemployment. The number of available jobs remains below those needed to accommodate population growth.(5) Increase employment consistent with the available work force, maintain wages constant, and decrease prices with productivity.

On a national level, purchasing power is increased, and industry still realizes some profit gains. This is the economic future.Lowering prices makes an entrepreneur shake - it implies losing and is interpreted as deflation. Static wages are politically incorrect and perceived as a betrayal to labor.

None of this is true. Rather than promoting deflation, the proposal is anti-inflation, preventing wages from falling and stimulating additional production to gain higher profits. The wage push inflationary cycle never gets off the ground and the signs in the stores are more attractive - reduced prices, come and shop. Rather than the economy running up and down it stays smooth, with slow but steady increases in GDP and national purchasing power.The obvious rebuttals to the "keep the prices down" proposal are that consumers will postpone purchases because they believe prices will fall further and borrowers will be hesitant to take on debt because they sense they will be paying back in stronger dollars rather than in weaker inflated dollars. Not foreseeing wage hikes in the future will also deter workers from purchasing expensive hard ticket items and make them unwilling to carry mortgages. If a homeowner cannot expect to make a bundle on his house, why bother buying it? These conventional arguments, which were never actually proven to apply in all cases, have no substance in this case.

Not many persons stop buying because they believe prices will go lower; they stop buying because they notice fellow workers are losing their jobs, companies are going bankrupt and they realize they are over budgeted. It's doubtful that the average consumer notices price trends but he/she notices the storm clouds and when its time to start saving a little more for the rainy day.

Wage hikes occur from inflation, from a rise in cost of living, and with it goes higher interest rates. Increases in housing prices, except for the bubbles, reflect the inflationary trend. Some buyers will rush to buy when they perceive inflation, pay the higher interest rate and turn their suspicion into reality - generating prtce inflation that leaves them with no more real wealth than if the inflation did not occur.

Others will pay higher prices for homes at lower mortgage rates. When it comes time to sell, the buyer with the higher interest rate will have much less equity in the home than the buyer with the lower interest rate and their speculative profit will be similar. Houses and mortgage rates are priced that way - the buyers of similar houses, after tabulating all costs, including real estate taxes, make similar profits and the mortgage lender does well.

The counter argument to the rebuttals is that the proposal is meant to diminish the economic restraints that the arguments proffer as beneficial. Running an economy on debt expansion until interest rates explode and demand falls rapidly, and purchasing homes for speculation rather than for definite use, are hindrances to a well functioning economy. Creating demand by lowering prices as a function of productivity, tempering credit expansion while maintaining low interest rates, and subduing speculative investing are the preferred conditions for establishing a smooth running economy.

One caveat - this proposal mainly applies to manufacture of goods that are highly elastic, where price changes affect demand. A simple comparison between three cases puts the concept in better perspective.

In the first case, the company reduces its manufacturing costs but does not initially increase production. If it is able to sell all production by maintaining prices, its profit will increase. This is what has happened after 2008. Eventually profits must be invested and production and jobs will increase; back to the 1980-2008 era and ultimate bust.

An alternative is to recover investment costs and reduce prices with time, assuring a quicker sale of goods and faster disposal of inventory.

In the second case, we have a company whose workers produce 10,000 widgets. Total wage bill (for simplicity all costs are a product of wages) is $9000, and each widget is priced at one dollar. One thousand widgets are surplus, which, if sold, can enable a profit of $1000.Productivity increases by 10 percent, and the same number of workers now produce 11,000 widgets. Management responds to the increased production and raises employee compensation by almost seven percent, which gives a wage bill of $9630. This leaves a potential profit to the company of $1470.

In the third case, instead of raising wages, the company lowers the price by five percent and keeps its wage bill at $9000. Each widget now costs $0.95. This leaves a potential profit to the company of $1450, about the same as before.

The one difference between the latter two examples is that the workers in the first example receive a wage increase and these particular workers have additional income to purchase their selected products. The second example spreads an increase in purchasing power for particular products to all consumers. However, if reducing prices in deference to increasing wages, as a function of productivity, becomes a standard motif for all manufacture, then all consumers will be able to increase their purchasing power for most products

.

Considering possible additional advantages of the latter example - export expansion, contraction in outsourcing leading to more jobs, positive current account, and smaller government deficit, and the choice between the examples tends to favor the lowering of prices with gains in productivity. The corporate strategies during The Gilded Age demonstrate its feasibility.Despite the elegance of Walrasian and other equations, theoretical efforts by John Maynard Keynes and Milton Friedman and a multitude of notable economists to explain and direct, the economy has moved on its own erratic and uncontrolled volition, going through cycles of prosperity and failure, enriching many, psychologically destroying more, and depending on government spending to resurrect it and keep it going. Convincing competing interests that a new direction toward utilization of productivity, which contradicts previously accepted notions, can benefit each of them and the overall economy, is not a simple task. However it deserves a look, and, if determined worthwhile and practical, deserves the means for implementation.

alternativeinsight

june 2014HOME PAGE MAIN PAGE

alternativeinsight@earthlink.net